|

|

|

|

|

|

|

|

|

|

|

|

529

Plans: Helping Employees Save for Education

|

Most employers recognize that for

many of their employees, saving

for a child’s education is a top

priority. With the cost of a private

four-year college education ranging

upwards of $80,000 (National Center

for Education Statistics, 2001),

saving early has become paramount

in helping to ensure a child’s schooling

and, for many employees, their own

continuing education. In particular,

529 college savings plans

(named for Internal Revenue Code

529) are a popular way to set money

aside for college and graduate school.

|

|

In response to the warm

reception these tax-advantaged savings

vehicles are receiving, particularly after

favorable changes made by the Economic

Growth and Tax Relief Reconciliation Act

of 2001 (Tax Relief Act), employers

seeking innovative ways to attract and

retain a qualified workforce have begun

offering the 529 plan as an incentive

in their benefits packages. Furthermore,

to ease the process for employees and

to encourage a disciplined approach to

saving, many companies allow contributions

to be easily made through payroll deduction.

Tax Advantages

529 college savings plans (not to be confused

with pre-paid tuition plans) are state-sponsored

investment accounts that offer two distinct

tax advantages: 1) the potential for earnings

to grow free of federal income tax; and

2) the opportunity for withdrawals to

be made free of federal income tax, if

funds are used for qualified education

expenses, such as tuition, fees, room,

and board. Certain state taxes may apply.

Nonqualified withdrawals may be subject

to a 10% federal income tax penalty. Prior

to the Tax Relief Act, beneficiaries of

a 529 plan had to pay federal income tax

on any earnings. However, on December

31, 2010 this provision is scheduled to

“sunset” and, if Congress does not act

in the interim, then regulations regarding

529 plans revert back to tax year 2001.

Contribution limits vary by state, and

in most states exceed $200,000. As an

employer-sponsored payroll deduction,

employees contribute a percentage of their

pay (similar to a 401(k) plan) to a 529

account. While contributors are not eligible

for any federal income tax deductions,

some states allow for certain state income

tax deductions. A person’s residency status

in the state sponsoring the plan generally

affects his or her state tax benefits,

which may affect employees of companies

with offices in different regions. For

example, suppose a company has an east

coast office and a west coast office.

The main office, which is on the east

coast, offers a 529 college savings plan

from that east coast state. This would

allow east coast employees to reap state

tax benefits, as well as federal tax benefits.

However, employees from the west coast

office, while sharing the potential for

earnings free of federal income tax, would

not qualify for any state tax benefits.

For contributors in all states, federal

gift taxes may also apply, but

a special provision applies to 529 plans.

In 2004, any individual may gift to another

$11,000 per year ($22,000 for married

couples) without incurring gift taxes.

However, individuals contributing to a

529 plan are allowed to make a lump sum

contribution of $55,000 ($110,000 for

married couples), using five years’ worth

of gifting. While this method limits tax-free

gifting for the next five years, it may

allow funds a longer time for potential

compound earnings.

Investment Options

Investment options vary by plan, but often

include a selection of mutual funds. Generally,

the diversification (a strategy

used to manage risk and maximize potential

earnings) of the portfolio’s assets is

based on the beneficiary’s age, or years

until the beneficiary begins college.

Remember that mutual funds are subject

to market risk, and shares, when redeemed,

may be worth more or less than the original

investment. The portfolio’s investment

strategy may be changed once (during a

calendar year) without incurring any federal

income tax penalties. Also, the account

holder may change the designated beneficiary

at any time without incurring federal

income tax penalties.

Before Beginning

In addition to understanding the

federal and state tax issues affecting

529 plans, it is also important to understand

the associated fees and expenses. These

vary by state and plan, but often include

enrollment fees, maintenance fees, sales

charges, management fees, and fund expenses.

For many employees, sending children to

college or continuing their own education

is a significant life goal. Offering a

529 plan with payroll deduction as part

of a benefits package may boost employee

satisfaction, which may help the business

owner retain a valuable workforce.

|

|

|

|

Don’t

Let a Disability Derail Your Company

|

Many business owners, who don’t

question the need for life insurance

coverage, often tend to overlook

the potentially greater risk from

a serious disability. According

to the Insurance Information Institute

(III, 2002), an individual age 40

has a greater chance of missing

at least three months of work due

to an accident or illness than of

suffering an untimely death.

|

|

How long would you be able

to cover your personal and business overhead

expenses if your income and revenues were

to stop today? As a business owner, you

could find yourself in a dire situation.

|

Consider the following hypothetical

example. Dave Harrison learned this

the hard way. At age 48, he was

the president and co-founder of

a small but growing electronic components

company. He thought he was in excellent

health. However, one day, without

warning, he suffered a minor cardiac

incident. Although it left no lasting

damage, the follow-up surgery resulted

in complications that sidelined

Dave for the next two years. By

the time he was finally able to

return to work, he had narrowly

missed declaring personal bankruptcy

and losing his business. Unfortunately,

his retirement savings had been

depleted in the process.

|

According to the National

Center for Chronic Disease Prevention

and Health Promotion (2002) chronic conditions,

such as heart disease, diabetes, and cancer,

are leading causes of disability and limit

the dail activities of 25 million Americans.

What can you if such a situation prevents

you from fully performing the duties of

your job? There are two important types

of insurance protection that can help

safeguard a portion of both your income

and your business.

First, disability income

insurance helps replace a portion

of your lost income while you are disabled.

Most employer-sponsored plans replace

salary for only a minimum period of time,

typically 26 weeks or less. However, you

can extend coverage either by purchasing

an individual disability policy or by

participating in a group plan through

a business or professional association.

When purchasing a policy, carefully examine

the definition of disability. Some policies

protect against loss if you are unable

to work in your own occupation, while

others cover you only if you are unable

to engage in any work at all.

Second, a business overhead policy

helps pay for a variety of overhead

expenses once you become disabled under

the terms of the policy. Thus, if you

are temporarily unable to generate revenue,

you can rest assured the bills will continue

to be paid without interruption.

If your disability becomes

permanent, there still is one glaring

issue that will need to be addressed—what

will happen to your company? Will you

be forced to sell it below fair market

value? If you have co-owners, they may

agree to continue your salary on a temporary

basis, but they may be unwilling to do

so indefinitely. With a disability

buy-out agreement, your salary would

continue for a specified period of time.

If it appears that you are permanently

unable to return to work, your co-owners

would be able to use the proceeds from

a disability buy-out policy to purchase

your share of the business.

Don’t let a disability derail your business.

Disability income insurance, a business

overhead policy, and a disability buy-out

agreement are tools that can help keep

your future—and that of your business—on

track. A qualified insurance professional

can assist you in creating a business

disability protection plan that is appropriate

for your needs

|

|

|

|

Estate

Strategies Can Present Challenges for

S Corporations

|

With advice from counsel and their

CPAs, many small business owners

choose Subchapter S as a business

entity primarily due to liability

and income tax considerations. However,

such an election may often result

in business continuation challenges

in later years, when estate planning

becomes a more crucial issue. Thus,

estate planning for S corporation

shareholders is essential because

the improper transfer of shares

could potentially terminate the

corporation’s S status. Therefore,

a carefully drafted buy-sell agreement

is of utmost importance to all shareholders.

|

|

Buy-Sell Agreement Considerations

A buy-sell agreement must address several

key issues to ensure the proper transfer

of shares and to maintain the integrity

of the S corporation status. The agreement

should detail who can and cannot be the

recipient of shares. This may include

prohibiting the transfer of shares to

partnerships, corporations, nonqualifying

trusts, and individuals other than nonresident

aliens. A sound agreement should also

contain a provision ensuring that the

number of shareholders will not increase

beyond 75. Otherwise, the S corporation

status could be terminated.

Another important issue that resulted

in closer scrutiny from the Internal Revenue

Service (IRS) was the possibility that

a buy-sell agreement could create a second

class of stock. However, regulations have

been enacted stating that as long as there

is a bona fide agreement to redeem or

purchase stock upon a specified triggering

event (i.e., death, disability, divorce,

or separation of service), such redemption

or purchase would not constitute the creation

of a second class of stock.

Additional planning considerations arise

with respect to the valuation of shares.

In order for the valuation of shares under

a buy-sell agreement to be recognized

for estate valuation purposes, the buy-sell

agreement must: 1) not serve as a mechanism

for transferring shares to family members

for less than full and adequate consideration;

2) be a bona fide business agreement;

and 3) have terms and provisions similar

to an "arm’s-length transaction." Also,

the share price that is set must apply

both during life and at death.

Finally, a determination must be made

as to the type of buy-sell agreement that

will be utilized and how the agreement

will be funded. Although various hybrid

arrangements exist, there are essentially

two types of buy-sell agreements: a cross

purchase and an entity purchase.

In brief, with a cross purchase, the individual

owners buy out the deceased or disabled

owner’s shares. On the other hand, with

an entity purchase, the business entity

buys out the deceased or disabled owner’s

shares.

Both arrangements have various advantages

depending on the type of entity and the

goals of the shareholders. For instance,

under a cross purchase arrangement, a

key advantage to the surviving S corporation

shareholders is that their basis will

increase by the amount of interest each

shareholder purchases, respectively. An

entity purchase does not afford shareholders

this benefit. However, because a cross

purchase requires arrangements between

shareholders, the demographics of the

shareholders (e.g., significant age disparity

or disproportionate ownership interests)

may be detrimental to the overall success

of such a plan. In this respect, an entity

purchase may be more appropriate in some

situations.

Funding a Buy-Sell Agreement

Generally, one of the best methods for

funding a buy-sell agreement is with life

insurance. Life insurance offers some

distinct advantages: 1) the only costs

to the shareholders (or corporation) are

for the premium payments and 2) the policy’s

death benefit proceeds are usually not

income-taxable to S corporation shareholders.

With a cross purchase arrangement, the

individual owners purchase a policy on

each individual. With an entity purchase

arrangement, the corporation purchases

a life insurance policy on each individual

owner.

|

Parting Thought

Estate and business continuation

planning for S corporation shareholders

can be exceedingly complex. Often,

such planning becomes a delicate

balance between meeting the organizational

goals of the S corporation and the

personal goals of the shareholders.

Thus, it is essential that all affected

parties consult with qualified legal,

tax, and insurance professionals.

|

|

|

|

|

|

Factors

to Consider When Selling Your Business

|

Successful business executives

have most likely devoted years to

building their companies. Yet, at

some point, they may contemplate

retiring or changing direction.

If selling your business is an option

on the horizon, there are a number

of important factors to consider

in ensuring a successful and profitable

sale.

|

|

Creating Market Value

One of the first questions to ask is,

"Who are the potential prospects for my

business?" Likely candidates may include

larger companies or competitors. However,

too often, private businesses are sold

through business contacts or as a result

of direct approaches made by potential

buyers. While an unsolicited proposal

is flattering to receive, such chance

opportunities may not yield the highest

value.

Another possibility is to

sell the company to employees through

an employee stock ownership plan (ESOP).

ESOPs are defined contribution plans and

are subject to the same guidelines imposed

on 401(k) and profit-sharing plans.

Although ESOPs give all employees a vested

interest in the company's profitability,

they can also function as a private marketplace,

enabling a retiring business executive

(or employee) to recognize a retirement

benefit by selling his or her shares back

to the ESOP. In some circumstances, the

executive may also be able to defer gain

on the sale of stock to the ESOP.

When actively seeking a buyer, it is also

important to keep in mind that there are

some actions you can take to increase

the value of your company. Just as banks

lend more readily when business prospects

are good, buyers are more receptive to

companies just ending prosperous years.

By planning to sell when your company's

performance is good, you can greatly influence

buyer interest and the value generated

in the marketplace. This can ultimately

help you negotiate the highest sale price

and draw the right buyer from among the

parties bidding on your business. Only

by meeting with a host of potential buyers

can you weigh the relative merits of each

proposed offer.

Consider Tax Effects

Review the net after-tax effect of any

proposed transaction with care. The tax

consequences of an asset sale are quite

different from those of a stock sale.

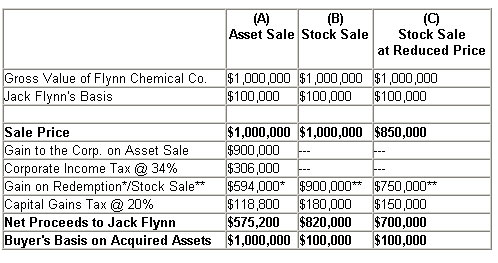

The accompanying chart illustrates the

impact of these two different scenarios,

along with a "compromise" option-a stock

sale at a reduced price.

Suppose Jack Flynn founded Flynn Chemical

Company, a "C" corporation, in 1980 with

$100,000 of personal capital. Today, Flynn

Chemical Company is worth $1,000,000 and

Jack has decided to sell his business.

Jack has an interested buyer, but he is

unsure whether to liquidate his company's

assets (Option A) or to sell his stock

outright (Option B). The chart below shows

the result of both methods.

Keep in mind, that it is also not uncommon

for negotiations to result in a compromise.

For instance, Jack may decide to sell

the stock to the buyer at a reduced price

(Option C). Jack's proceeds will still

be substantial-more than if he had sold

the assets outright-and the buyer's concerns

about not receiving a step-up in basis

for the acquired assets will, more than

likely, be outweighed by the reduced sales

price.

Note 1: With an asset sale,

in addition to the $900,000 gain to Flynn

Chemical Co., for the amount received

over the corporation's basis in the assets,

there may be a gain to Jack Flynn as an

individual taxpayer upon liquidation of

the business. Note 2: This example is

for hypothetical purposes only. It is

not intended to portray past or future

investment performance for any specific

investment. Your own investment may perform

better or worse than this example.

Personal Planning-Front

and Center

Regardless of which option you decide

to pursue, your initial efforts should

focus on a close examination of your personal

planning needs and concerns. If you are

like many business executives, you have

probably had little time to devote to

your personal financial and estate planning

needs.

In addition, you could be holding a compensation

package that contains benefits that are

not portable. Other benefits, such as

deferred compensation, may not be available

for your current use, while some benefits

may become available only upon retirement

or death.

Because much of your worth may be tied

up in your company's stock, it is important

to review the proper tax, estate, and

financial planning issues prior to the

actual sale of your business.

Now

may be a good time to meet with your financial

service professional to minimize any tax

liabilities, and to help guide you over

the potential legal, tax, and accounting

hurdles that may arise. Intermediaries

can help you set realistic goals, sort

through potential buyers, negotiate with

interested parties, and select the most

advantageous offer to ensure the maximum

future benefit for you and your family.

|

|

|

|

Family

Employees Bring Home Tax Benefits

|

If you are the owner of a small

business, employing your children

may help reduce both your family's

aggregated income subject to taxation,

as well as the effective rate at

which that income is taxed. This

fact applies whether you are running

your business as a corporation,

partnership, or sole proprietorship.

Putting a family member on your

payroll makes that person's income—and

the proportional costs of his or

her employee benefits— deductible

business expenses.

|

|

As a result, the gross income

of your business is lowered. While the

total family income may remain essentially

the same, the income paid to the family

member (assuming he or she is not a spouse)

is generally taxed at a lower rate. In

addition, certain employee benefits are

not taxable to the family member. Under

this scenario, the family's overall tax

liability is lowered.

Good News-Now and Later

Suppose that you have a teenage daughter,

Susan, who has good computer skills. If

you directly pay Susan the going rate

for maintaining your database, and keep

a record of her hours and the work performed,

her salary is tax deductible as a business

expense. As long as her wages are less

than the standard deduction ($4,850 for

2004), her income will be nontaxable.

Income above that amount will be taxed

at Susan's presumably lower tax rate.

Remember, however, that by putting her

on your payroll you may be unable to claim

Susan as a dependent.

Alternatively, imagine that

daughter Susan is still an infant. If

Jane, your spouse, works in your business,

the cost of paying for childcare while

she works will be lessened through the

allowable childcare tax credit for

such expenses.

Looking forward 20 years into the future,

having Jane on the payroll could help

out with retirement planning. Your company's

pension, or defined benefit plan,

which qualifies under the Employee Retirement

Income Security Act (ERISA, amended in

1974), allows Jane to receive an annual

minimum distribution of $10,000, regardless

of whether her annual salary ever got

that high. Most importantly, during Jane's

20 years of service, your business was

able to deduct contributions to the plan

on her behalf from gross income.

Perhaps your business offers a 401(k),

a type of profit sharing plan. If so,

the contributions made by your business

to Jane's account, up to a certain amount,

also qualify as a tax-deductible business

expense.

IRAs are Family-Friendly

If your business does not offer a qualified

retirement plan, or family members like

Jane and Susan do not participate in such

a plan, then Individual Retirement Accounts

(IRAs)—available only to employed individuals

or their spouses—are an option. IRA contributions,

under current law, $3,000 per year*, are

tax deductible subject to certain income

limits for the employee (but not to the

business) and allow for tax deferral on

earnings until withdrawal. SIMPLE IRAs

allow annual tax-deductible contributions

up to $9,000 in 2004.** Contributions

that are matched by the employer are deductible

as a business expense.

In Sickness and In Health

As employees, Jane and Susan are eligible

for other employee benefits your company

may elect to provide, such as accident

and health coverage, group term life insurance,

and tuition assistance. The costs

of these benefits, assuming they are reasonable,

are also deductible business expenses.

You should keep in mind that employing

family memebers means they must actually

work in the business for compensation

that is reasonable for the type of work

they are performing. Also, be aware that

the tax status of any retirement account

or plan vehicle (and there are many types)

is strictly governed by statutes and regulations

that cover both employer and employee.

Nonetheless, putting family members on

the payroll can often clear financial

and tax benefits.

*The $3,000 IRA contribution limit

will be increased to $4,000 in 2005, and

$5,000 in 2008 and later years. The IRA

contribution limit would be indexed for

inflation, in $500 increments, after 2008.

Catch-up contributions will also be allowed

for taxpayers who are age 50 and older.

In calendar years 2002-2005, the catch-up

contribution limit will be $500. For 2006,

and later years, the contribution limit

will be $1,000.

**As of 2002, the salary deferral contribution

limit was increased from $6,500 as follows:

$7,000 in 2002; $8,000 in 2003; $9,000

in 2004; and $10,000 in 2005 and later

years. Thereafter, the SIMPLE IRA limit

will be indexed in $500 increments. Also,

taxpayers age 50 or older will be permitted

to make catch-up contributions. The amounts

are as follows: $500 in 2002; $1,000 in

2003; $1,500 in 2004; $2,000 in 2005;

and $2,500 in 2006 (indexed in $500 increments).

|

|

|

|

Intrafamily

Transfers Using a Private Annuity

|

In many closely-held businesses,

the goals of a succession plan often

include providing the owner with

lifetime income, minimizing estate

taxes, and transferring ownership

to children under terms which they

can afford.

|

|

Consider Joseph Wyatt, a 100% shareholder

in Wyatt, Inc., a real estate property

management company. He has two children

active in the business, and since he is

nearing retirement, he would like them

to succeed him as officers and owners.

Furthermore, since the closely-held stock

makes up the bulk of his estate, he is

looking to the business to provide most

of his retirement income.

Joseph and his children could structure

a private annuity which would provide

periodic fixed payments to Joseph over

his lifetime, in return for transferred

ownership of the business. A private annuity

is an arrangement whereby one person (the

transferee or obligor) who is not in the

business of writing annuities agrees to

make periodic payments to another person

(the transferor or obligee), usually for

the obligee`s life, in exchange for a

property transfer.

If the value of the property transferred

and the value of the annuity (actuarially

determined using IRS tables) were equal,

there would be no gift. If the property

transferred was worth more than the promised

annuity, the excess would be deemed a

gift and could have gift tax consequences.

Upon Joseph’s death, the obligation of

his children would end, and nothing relating

to the value of the business would be

included in his gross estate.

Potential Advantages

|

|

Estate Tax Savings--The

property is immediately removed

from Joseph`s estate; future appreciation

of the business is shifted to his

children.

|

|

|

Lifetime Income-- Joseph

receives an economic benefit (i.e.,

lifetime income) as if the transferred

property had been retained

|

|

|

Income Taxes--The income

from the annuity is partially a

tax-free return of basis and partially

a long-term capital gain; there

are no payroll taxes associated

with the annuity income.

|

No "Deferred Gain" Consequences at Death--Any

deferred gain at Joseph`s death is not

"income with respect to a decedent" in

his estate; in contrast, had an installment

sale been used, any "notes" not yet paid

at Joseph`s death would be included in

his gross estate.

Potential Disadvantages and Concerns

|

|

Income Taxes-- Joseph`s

children must make the annuity payments

with after-tax dollars; there is

no interest deduction for any portion

of the payments as there would be

in an installment sale.

|

|

|

Characterization as Retained

Life Estate--In order to avoid

potential retained life estate problems

under Sec. 2036, there must be no

strings attached (e.g., retained

voting rights by Joseph) to the

transferred property.

|

|

|

Security--The private annuity

contract must be an unsecured promise

to pay in order to achieve the benefits

of the annuity tax rules and avoid

immediate tax on the gain.

|

|

|

Valuation and Gift Taxes--Any

excess of the property`s value over

the present value of the annuity

will generally constitute an immediate

gift. With closely-held stock, and

other types of property where exact

valuation may be difficult, the

IRS may challenge the valuation

used in creating the annuity contract.

|

|

|

No Basis Step-up--The children

do not get the stepped-up basis

which would apply if the stock were

inherited. Rather, their basis is

equal to all the payments made up

to Joseph’s death.

|

|

|

Estate Taxes--By transferring

the property in exchange for the

annuity, the property is removed

from Joseph’s estate. However, if

Joseph allows the payments received

to accumulate, and he exceeds his

life expectancy, the estate tax

savings may be illusory unless such

income is consumed or otherwise

disposed.

|

In appropriate circumstances, the private

annuity has been a valuable intrafamily

estate planning tool, enabling the transfer

of appreciated property to younger family

members in exchange for lifetime payments

to an older generation transferor. However,

because the private annuity is typically

a transaction between related parties,

its use may come under more careful scrutiny

by the IRS. Familiarity with Chapter 14

of the IRC (particularly Sec. 2703) will

be helpful for anyone considering the

use of this transfer technique.

|

|

|

|

Issues

Facing Today

|

An individual who is an owner

of a family business is in a rather

unique estate planning situation.

Often, their business interest makes

up a majority of their estate. Thus,

on one hand lies the issue of estate

taxes and the future of the business,

while on the other hand, there is

the complex issue of determining

the value of a family-owned business

for estate tax and/or business continuation

purposes.

|

|

First Steps

Typically, a number of personal, business,

and tax-related issues need to be addressed.

For instance, are there any family members

interested in taking over the business?

Will the business owner's estate have

adequate liquidity to pay estate taxes?

Is the business marketable if it must

be sold? What types of financial contingencies

are in place to provide for a spouse or

for family members after the owner's death?

These are just a few of the many questions

facing a family business owner.

Because an owner's business interest is

an asset, and will be included in the

owner's estate, initial planning often

focuses on the maximization of the applicable

exclusion amount. The owner of a qualified

family-owned business (QFOB) is given

a deduction which, when added to the applicable

credit amount, totals $1,300,000.

This deduction raises several interesting

planning points. First, any combined use

of the deduction and the applicable credit

amount cannot exceed $1,300,000 in any

year. Therefore, as the applicable exclusion

amount gradually increases over the next

several years (thanks to the Economic

Growth and Tax Relief Reconciliation Act

of 2001) from $1,000,000 in 2002 to $3,500,000

in 2009, the deduction for a QFOB actually

decreases from $300,000 in 2002 to its

complete elimination in 2004.* Second,

in order to qualify for the deduction:

- the decedent's

interest must be greater than 50% of

his or her estate;

- family

members must have participated in the

business for at least 5 of 8 years within

a 10-year period prior to the decedent's

death; and

- if any

interest is sold to a nonfamily member

within 10 years after the decedent's

death, the tax savings will be recaptured.

As a result, if a family business qualifies

for the exclusion at the time of the decedent's

death, family members participating in

the business should be made aware of the

potential tax ramifications if any business

interest is sold in the future.

Gaining Perspective with Business Valuations

Once the applicable credit amount and

special estate tax exclusion for qualified

family-owned businesses are analyzed,

an owner can turn his or her attention

to the family business itself, and how

it fits into their overall estate plan.

Generally, the owner will have three choices

for the future of the business:

- keep the business in the family;

- sell the business; or

- liquidate

the business.

Although each option requires different

planning strategies and has its own set

of potential problems and concerns, there

is a similarity among each choice. Upon

the owner's death, the business must be

accurately valued for estate tax purposes

to help ensure the proper and timely disposition

of business interests.

Generally, there is no readily available

means for determining the fair market

value of a family-owned business. Consequently,

alternative valuation methods must be

used before the value of the business

can be determined.

One important factor the business valuation

process reviews is the nature and history

of the business. For the Internal Revenue

Service (IRS), the key to this factor

is the identification of risk. While disregarding

past events that are unlikely to recur

in the future, the IRS believes capital

structure, sales records, growth, and

diversity of operations can speak volumes

about past business performance and how

the business will fare in the future.

Next, the economic outlook for the country,

as well as the geographic location of

the business, must be factored into the

appraisal. The key to this element is

the future potential for business profits;

the greater the expectation of profits,

the greater the value of the business.

Where a particular business stands in

relation to its competitors is often a

good indicator of future business profits.

The appraiser is required to evaluate

the industry, as well as the position

of the particular business within the

industry.

Taken together, the book value and financial

condition of the business form the third

factor that must be weighed. Book value,

defined as assets minus liabilities, is

readily obtained from the balance sheet.

In most cases, however, balance sheet

adjustments will have to be made to book

value in order to accurately reflect economic

versus tax depreciation.

The IRS often finds this fourth factor,

earnings, to be the most important criteria

in service-based businesses. It is often

common for appraisers to "capitalize"

earnings as a means of reducing future

income to a single number, otherwise referred

to as present value. Capitalizing earnings

is nothing more than a fancy method used

to answer the question of how much an

individual will pay for a business given

the level of risk involved.

Where appropriate, the dividend-paying

capacity of the company will be examined,

as well. The IRS believes that dividends

are not a reliable criteria of market

value in the closely-held company, however,

since the controlling stockholders have

the discretion to pay deductible salary

and bonuses as opposed to nondeductible

dividends.

Finally, goodwill, or the ability of a

business to earn a return over and above

what it could on its fixed assets, represents

the sixth, and possibly most difficult,

factor to value. Intangible goodwill value

can come from such things as the location

of the business, the reputation of the

business, or a specific list of customers.

Goodwill is usually most difficult to

value in those businesses that have no

intangible assets.

|

Family business owners are in a

truly unique estate planning situation.

As a result, already complex planning

can easily become more involved

when one figures in the qualifications

for the new small business exclusion

and the rigors of a small business

valuation. As with all advance planning,

it is important to review and solidify

the business owner's goals and objectives

before proceeding with any course

of action. In addition, business

valuations should be performed by

a licensed professional business

appraiser.

|

|

|

|

|

Keeping

Sight of Personal Priorities

In the rush of day-to-day business

activities, many business owners find

that it can be easy to lose sight of

what they hope to achieve from their

efforts. It is also true that their

objectives may change as the business

grows, and the owner ages. Do you ever

stop to reevaluate your personal goals

and priorities? The following are some

of the more important concerns of many

small business owners:

Strengthen Personal

Finances.

A top issue for many small business

owners is strengthening their personal

finances. Are you "just getting by"

or comfortably making ends meet? By

conducting regular financial reviews,

and taking follow-up action as needed,

you can help to develop and solidify

your personal financial position.

Build Wealth.

Business owners often become so engrossed

in running their companies that they

put their personal finances on the back

burner. Many also tend to have most

of their liquid assets tied up in the

business. However, to build personal

wealth, it is also important to focus

attention on your personal savings and

attempt to make this a priority.

Prepare for Retirement.

Many tax-advantaged, qualified retirement

savings vehicles are available to business

owners and their employees. The size

of your company and the ages and salaries

of your employees often determine which

type of retirement plan is best for

you. In addition, non-qualified plans

allow you to selectively benefit yourself

and your key employees.

Develop an Exit Strategy.

Will your small business be marketable

if you decide to sell? It is important

to develop an exit strategy that can

help provide cash commensurate with

the value of your business in the event

you choose—or are forced—to sell due

to death or disability.

Keep Your Company within the Family.

Many small businesses are operated by

more than one family member. If you

wish to keep your business within your

family, you should learn about transfer

tax issues and develop a business succession

plan that meets your goals and objectives.

|

|

|

|

Key

Person Insurance Protecting Your Most

Valuable Assets

|

As a business executive, suppose

you were to arrive at your desk

one morning only to be informed

that your key sales manager had

died unexpectedly during the night.

Have you ever considered how such

a turn of events might affect your

company? Along with losing a valued

member of your management team,

you would also be losing the manager’s

skill, “know-how,” and, perhaps,

the important business relationships

he or she had cultivated over the

years.

|

|

Navigating the Shoals

Although you can’t prevent the sudden

and unexpected loss of a critical employee,

you can receive compensation through key

person insurance. A key person policy

covers or “indemnifies” a company against

the loss of a valued team member’s skill

and experience. The proceeds can help:

provide funds to recruit, hire, and train

a replacement; restore lost profits; and

reassure customers and lenders that business

operations will continue and funds will

be available to help repay business loans.

Generally, the company owns the policy,

the premiums are not deductible, and the

death proceeds are received by the company

free of income taxes [although there may

be alternative minimum tax (AMT) consequences

for businesses organized as C corporations].

Charting a Course

Needless to say, it is not easy placing

a value on a key employee. Generally,

there are three different approaches to

determine the amount of insurance that

is necessary.

One of the most common methods is called

the “multiple” approach. This method uses

a multiple of the key person’s total annual

compensation, including bonuses and deferred

compensation. The disadvantage to this

approach is that the estimate, typically

for five or more years’ annual compensation,

may or may not relate to actual needs.

The popularity of this method may simply

be a reflection of the difficulty business

executives have in quantifying a key employee’s

value.

A more sophisticated method is the business

profits approach. This method tries to

quantify the portion of the business’s

net profit that is directly attributable

to the efforts of the key person and then

multiplies that amount by the number of

years it is expected to take for a replacement

to become as productive as the insured.

For example, if the estimate of net profit

attributable to the key employee is $250,000

annually, and it is estimated that it

would take five years to hire and train

a replacement, then, the policy’s face

amount would be $1.25 million under this

method.

A third method determines

the present value of the profit contributions

of the key employee over a specified number

of years. This quantity is then used as

the face amount of the policy. For a simplified

example, with anticipated profit contributions

of $250,000 per year for the next five

years and a discount rate of 8 percent,

the policy’s face value would be about

$1 million. This method assumes the insurance

proceeds can be invested at some rate

of return and will be expended over a

period of years. Business executives should

consult with their insurer regarding the

company’s specific “rule of thumb” approach.

Regardless of which method

is best suited for your business, key

person insurance is a vital component

to consider in protecting your business

from the loss of your most valuable assets—the

people who help it grow and prosper. In

addition to providing cash to recruit,

hire, and train replacements, the proceeds

can also be used to help restore lost

profits, maintain customer satisfaction,

and lender obligations.

|

|

|

|

Nonqualified

Plans—Baiting the Benefit Hook

|

Attracting and retaining qualified

employees and managers is a constant

challenge, especially in today’s

tight labor market. Most employers

realize competitive salaries are

not enough to win over the best

workers. Sought-after employees

also expect compensation packages

to include desirable benefits.

|

|

Qualified retirement plans

are a traditional component of many employee

benefit packages. As a business owner,

you’re likely to appreciate their advantages:

your contributions are tax deductible

and accumulate on a tax-deferred basis.

Unfortunately, these plans are difficult

to administer and contain many regulations

restricting employee eligibility, participation,

vesting, and employee contributions.

What’s the alternative? Nonqualified plans

offer the flexibility to selectively choose

whom you’ll cover and how much you’ll

contribute for each individual. Many companies

use them to supplement or replace their

qualified plans. Although there is a wide

range of nonqualified plans from which

to choose, executive bonus plans and

deferred compensation plans are among

the most popular.

Executive Bonus Plans

If you’re looking for a plan that provides

a current tax deduction, consider the

executive bonus plan. This strategy

makes sense when your company’s tax bracket

exceeds your personal tax bracket. Here’s

how it works: you choose which workers

you wish to reward with a bonus. The bonus

comes in the form of a life insurance

policy on the selected employee with premiums

paid by your company.

This approach will likely appeal to you

for its simplicity. And, it benefits your

employee as well, since his or her family

receives additional protection over what

the company’s group life insurance plan

offers. The employee can also look forward

to having access to the policy’s cash

value, which can be used to help supplement

future college costs or retirement income.

Restrictive Executive Bonus Plans

A twist on the preceding plan is the restrictive

executive bonus plan. This resembles

a regular bonus plan, except that your

company retains greater control over the

life insurance policy. This is accomplished

by attaching a special endorsement that

prohibits the employee from surrendering,

loaning, or withdrawing the cash value

from the policy. Control of this agreement

is spelled out in a contract that defines

your company’s rights and the vesting

terms for the employee. Restrictive bonuses

are a relatively new approach and provide

an effective means for rewarding key employees—including

yourself—while retaining some measure

of company control over plan assets.

(Note: Using such restrictions may cause

your company to be considered a beneficiary,

since you exercise control over the policy

and may have access to cash values. This

could affect your company’s ability to

take a tax deduction for your contributions

to the plan. It may be best to discuss

this issue with your accountant.)

Deferred Compensation

Plans

With a deferred compensation arrangement,

you agree to continue an employee`s salary

for a specified period of time after retirement.

Although the company`s contribution to

the plan is not currently tax deductible,

deferrals grow tax free provided the company

uses a tax-deferred investment vehicle,

such as life insurance. The advantage

of a deferred compensation plan is that

it gives your company control of the funding

vehicle. However, it is up to you to decide

whether you’d rather have a current tax

deduction or one that’s deferred. This

is another issue you may wish to discuss

with your accountant.

In today’s competitive job market, highly

qualified employees are not always easy

to come by. When fishing for the best

workers, the lure of nonqualified plans

with their selective benefits can help

you bait your benefit hook.

|

|

|

|

Pacing

Your Company’s Growth

|

It’s only natural for many entrepreneurs

to entertain thoughts of achieving

hugely successful businesses. Perhaps

they hope to follow in the footsteps

of those companies that seem to

spring fully-grown overnight. Yet,

it’s worthwhile for business owners

to ask at the outset—“What is the

best measure of success?” Bigger

isn’t always better. While outside

observers often tend to measure

a company’s success solely by its

growth, progress, and sustainable

profitability aren’t always reflected

in the number of employees or the

size of a company’s revenues.

|

|

Small companies that grow

slowly may have an edge in sustaining

growth over the long term. In this regard,

it’s important for owners to keep sight

of what motivated them to go into business

in the first place. For instance, a desire

to be responsive to customer needs and

to be creative in meeting them may be

best cultivated in a small business setting.

Here are some strategies that can help

a company maintain its small business

edge:

Differentiate the Company

Carve out a niche with a clearly defined

mission and target market. For instance,

by defining itself as “a one-stop communications

resource, specializing in small to midsize

companies,” a company can help position

itself to remain small enough to offer

personalized attention to clients, while

allowing for enough growth to provide

expertise across a broad range of communication

needs.

Build on Existing Capabilities

Actively seek new ways to use existing

capabilities to serve customers. For instance,

if our one-stop communications company

initially focuses on developing marketing

materials for customers through one-on-one

verbal communications, as its clients

expand their operations into cyberspace,

it might also consider developing its

own website to reach its customer base

Experiment with New Ideas

Make it a practice to cultivate creative

approaches to meeting customers’ needs.

For example, services can be developed

on a trial basis with one or two clients.

If a problem develops, or there is little

interest among customers, the service

can simply be discontinued.

Small companies often benefit from many

advantages large businesses may lack.

For instance, they may find it easier

to remain close to their customer base

by responding more quickly to customer

needs. This kind of personalized attention

can help build customer loyalty and may

lead to referrals and new customers.

Many successful small businesses

fail when they attempt to expand too rapidly.

Slow, steady growth can help a company

retain its uniqueness, responsiveness,

and creative approach over the long run.

By cultivating its small business edge,

a company can not only generate the potential

for growth, it can also help build a solid

foundation for sustaining it.

|

|

|

|

Raising

Capital for Your Business Needs

|

Raising capital for your business

can be an extremely complex process.

What should you use- debt (borrowed

funds), equity (capital that does

not need to be repaid), or a combination

of the two? Whether your business

is a start-up venture or an established

enterprise, these financing decisions

will directly affect the potential

growth and profitability of your

business.

|

|

Debt Financing

Like many business owners, you may favor

debt financing because creditors

and lenders have no direct claim on the

future earnings or value of your company.

Your obligation to creditors ends when

you repay the debt. Another benefit of

debt financing is the interest paid on

loans can be deducted on your company’s

tax return, lowering your real cost of

capital.

Despite these advantages, debt can put

a considerable strain on your business,

especially if cash flow is weak. Regardless

of your business’s financial position,

both principal and interest must be repaid

in a timely manner, and usually within

a relatively short time period. In addition,

interest is a fixed cost that will increase

your company’s “break even” point. If

your business experiences financial problems,

debt can drastically affect profitability.

Although your obligation to the creditor

ends when you repay a loan, the creditor

may include restrictive covenants

(e.g., restrictions on capital expenditures)

as a contingency for granting the loan.

These covenants may severely limit your

control over business operations.

Equity Financing

Equity financing provides capital that

does not need to be repaid, making it

particularly attractive to businesses

without enough cash flow to service debt.

In addition, equity financing has no fixed

cost. Equity financing, however, can significantly

dilute your ownership interest and may

diminish your operating control. Due to

these risks, equity providers may request

a position of authority within the company,

such as a seat on your board of directors.

If your business is well established,

this request may be an infringement. If

your business is new, you may benefit

from the investor’s knowledge.

The real cost of equity financing, however,

is often greater than debt financing for

two reasons: 1) due to generally higher

risks, investors may require greater returns

on investment than creditors, and 2) dividends

are not tax deductible, therefore leading

investors to expect sizable capital gains

from business growth.

Debt/Equity Combinations

When weighing the advantages and disadvantages

of debt versus equity, you may discover

that neither straight debt nor straight

equity adequately meets the capital needs

of your business. Therefore, you may want

to consider a combination of debt/equity.

One option is to couple debt with equity

additions, which are warrants that enable

investors to purchase a portion of your

company’s stock at a fixed price sometime

in the future. Such an arrangement may

improve your chances of securing financing

because investor risks are reduced and

returns are increased. This method will

also minimize debt service and limit the

amount of equity you must relinquish.

Finding the Right Ratio

What is the correct debt-to-equity ratio

for your business? There is no right or

wrong answer to this question. However,

if your business has an abnormally high

debt-to-equity ratio, there is some risk

that your debt instruments may be re-characterized

as equity for tax purposes. Also, potential

investors or lenders reviewing your company’s

financial statements will look for a debt/equity

ratio consistent with the industry average

for your particular business. Bankers

have access to these industry standards.

If your business currently has a high

debt-to-equity ratio compared to others

in your industry, you may want to consider

seeking equity financing. Lending institutions

usually avoid highly leveraged companies

for fear these companies will have difficulty

meeting interest and principal payments.

If your business has a low debt-to-equity

ratio, consider pursuing debt financing.

Lenders view highly capitalized businesses

as stable and, consequently, may be more

willing to make favorable loans.

Of course, the amount of debt or equity

your business is currently carrying should

not be the only factor affecting your

financing decisions. In addition to ratios,

factors such as level and stability of

cash flow affect business continuity and

should also be examined.

|

Assessing the type of financing

that may be best suited for your

company can be a difficult process.

Consultation with a financial service

professional can assist you in making

the appropriate financing decisions

for your business.

|

|

|

|

|

Securing

a Business Loan with Term Life

|

As a business executive, you have

probably worked long and hard to

help build a successful company.

In today's thriving economy, with

strong demand for many products

and services, you may want to take

full advantage of your opportunities

to expand. Yet, even when profit

projections look good and a project

is backed by a sound business plan,

your banker may be reluctant to

lend the necessary funds.

|

|

The reason for this reluctance

could be the fact that the bank is concerned

that, despite an excellent credit standing,

the success of your venture depends too

heavily on your personal involvement.

If you were to suffer an untimely death,

the bank could stand to lose a significant

sum.

On the other hand, the bank is in the

business of lending funds. If you have

had a close working relationship with

your bank, and your banker has confidence

in your abilities, it is likely your lender

will want to continue to "partner" your

business as it grows and develops. What

can be done to resolve the situation?

A Life Insurance Strategy

Life insurance may offer an answer. Life

insurance is an important element in many

business arrangements. One of its many

uses is securing a business loan. If your

new or expanding business requests a loan,

your lender may require you to secure

the loan if the company lacks collateral

to back the loan, or if the lender is

concerned that your company depends too

heavily on the talents of a particular

individual.

Term life insurance is designed

to protect against financial risk for

a specified period of time in the event

of the insured's death. With a term policy

on your life for the duration of the loan,

say five years, the bank's security requirements

may be satisfied. In addition, term life

benefits a business owner by providing

a safety net that protects his or her

estate if things don't work out as anticipated.

Policy Assignments

By assigning your policy, you transfer

your rights to all, or a portion, of the

proceeds to the bank. The extent to which

these rights are transferable depends

on the assignment provisions in the policy,

the intention of the parties as expressed

in the assignment form, and the actual

circumstances of the assignment. Two common

types of insurance policy assignments

are:

|

|

Absolute assignments -These

normally assign every policy right

the policyholder possessed prior

to the assignment. Once the transaction

is complete, the policyholder will

have no further financial interest

in the policy.

|

|

|

Collateral assignments -These

are more limited types of transfers.

They can protect the lender by using

the policy as security for repayment.

When the loan is fully repaid, the

bank releases its interest in the

policy.

|

Life insurance policies generally can

be freely assigned, unless some limitation

is specified in the contract. To fully

protect the assignee, the insurance company

must be notified that the assignment has

been made. It is also important to notify

the insurer if future assignments are

made and/or terminated.

Benefits after the Loan is Repaid

Term life offers benefits even after the

loan has been repaid. At that point, you

could convert the policy to permanent

coverage to be used for a number of other

business purposes. These may include funding

a buy-sell agreement, a disability buyout

agreement, or a deferred compensation

plan. If you have no further need for

the insurance, you could simply decide

to let the term policy lapse.

To succeed in the long run, small businesses

need to take advantage of their opportunities

to grow. Yet, a lender may be unwilling

to share in the calculated financial risk

of an entrepreneur-even one whose efforts

it supports.

A term policy can be an economical method

of making a business loan possible by

providing a safety net that secures repayment

for a lender. For more information on

how life insurance can help meet your

company's needs, consult a qualified insurance

professional.

|

| |

| |

|

|

|

|

|