|

|

|

|

|

|

|

|

|

|

|

|

Eldercare

Can Be a Medical Deduction

With people living longer, many find themselves

becoming the care provider for elderly

parents, spouses and others who can no

longer live independently. When this happens,

questions always come up regarding the

tax ramifications associated with the

cost of nursing homes or in-home care.

Generally, the entire cost of nursing

homes, homes for the aged, and assisted

living facilities are deductible as a

medical expense, if the primary reason

for the individual being there is for

medical care or the individual is incapable

of self-care. This would include the entire

cost of meals and lodging at the facility.

On the other hand, if the individual is

in the facility primarily for personal

reasons, then only the expenses directly

related to medical care would be deductible

and the meals and lodging would not be

a deductible medical expense.

As an alternative to nursing homes, many

care providers are hiring day help or

live-in employees to provide the needed

care at home. When this is the case, the

services provided by the employees must

be allocated between household chores

and deductible nursing services. To be

deductible, the nursing services need

not be provided by a nurse so long as

the services are the same services that

would normally be provided by a nurse

such as administering medication, bathing,

feeding, dressing etc. If the employee

also provides general housekeeping services,

then the portion of employee's pay attributable

to household chores would not be a deductible

medical expense.

Household employees, like other employees,

are subject to Social Security and Medicare

taxes, and it is the responsibility of

the employer to withhold the employee's

share of these taxes and to pay the employer's

payroll taxes. Special rules for household

employees greatly simplify these payroll

withholding and reporting requirements

and allow the Federal payroll taxes to

be paid annually in conjunction with the

employer's individual 1040 tax return.

Federal income tax withholding is not

required unless both the employer and

the employee agree to withhold income

tax. However, the employer is still required

to issue a W-2 to the employee and file

the form with the Federal government.

A Federal Employer ID Number and a state

ID number must be obtained for reporting

purposes. Most states have special provisions

for reporting and paying state payroll

taxes on an annual basis that are similar

to the Federal reporting requirements.

If you need assistance in setting up a

household payroll, please contact this

office for additional details and filing

requirements.

|

|

|

|

Impairment-Related

Medical Expenses

Amounts paid for special equipment installed

in the home or for improvements may be

included in medical expenses, if their

main purpose is medical care for the taxpayer,

the spouse, or a dependent. The cost of

permanent improvements that increase the

value of the property may be partly included

as a medical expense. The cost of the

improvement is reduced by the increase

in the value of the property. The difference

is a medical expense. If the value of

the property is not increased by the improvement,

the entire cost is included as a medical

expense.

Certain improvements made to accommodate

a home to a taxpayer's disabled condition,

or that of the spouse or dependents who

live with the taxpayer, do not usually

increase the value of the home and the

cost can be included in full as medical

expenses. These improvements include,

but are not limited to, the following

items:

|

|

Constructing entrance or exit ramps

for the home,

|

|

|

Widening doorways at entrances

or exits to the home,

|

|

|

Widening or otherwise modifying

hallways and interior doorways,

|

|

|

Installing railings, support bars,

or other modifications,

|

|

|

Lowering or modifying kitchen cabinets

and equipment,

|

|

|

Moving or modifying electrical

outlets and fixtures,

|

|

|

Installing porch lifts and other

forms of lifts but generally not

elevators,

|

|

|

Modifying fire alarms, smoke detectors,

and other warning systems,

|

|

|

Modifying stairways,

|

|

|

Adding handrails or grab bars anywhere

(whether or not in bathrooms),

|

|

|

Modifying hardware on doors,

|

|

|

Modifying areas in front of entrance

and exit doorways, and

|

|

|

Grading the ground to provide access

to the residence.

Only reasonable costs to accommodate

a home to a disabled condition are

considered medical care. Additional

costs for personal motives, such

as for architectural or aesthetic

reasons, are not medical expenses.

|

|

|

|

|

Nursing

Services

Nursing Services Wages and other amounts

paid for nursing services can be included

in medical expenses. Services need not

be performed by a nurse as long as the

services are of a kind generally performed

by a nurse. This includes services connected

with caring for the patient's condition,

such as giving medication or changing

dressings, as well as bathing and grooming

the patient. These services can be provided

in the home or another care facility.

Generally, only the amount spent for nursing

services is a medical expense. If the

attendant also provides personal and household

services, these amounts must be divided

between the time spent performing household

and personal services and the time spent

for nursing services. However, certain

maintenance or personal care services

provided for qualified long-term care

can be included in medical expenses.

Additionally, certain expenses for household

services or for the care of a qualifying

individual incurred to allow the taxpayer

to work may qualify for the child and

dependent care credit. Part of the amounts

paid for that attendant's meals are also

included in medical expenses. Divide the

food expense among the household members

to find the cost of the attendant's food.

If additional amounts for household upkeep

were paid because of the attendant, include

the extra amounts with the medical expenses.

This includes extra rent or utilities

paid because a larger apartment was needed

to provide space for the attendant.

|

|

|

|

Medical

Dependents

Medical expenses paid for dependents may

be deducted. To claim these expenses,

the person must have been a dependent

either at the time the medical services

were provided or at the time the expenses

were paid. The qualifications for a medical

dependent are less stringent than those

for a regular dependent. A person generally

qualifies as a dependent for purposes

of the medical expense deduction if:

- That person

lived with the taxpayer for the entire

year as a member of the household or

is related

- That person

was a U.S. citizen or resident, or a

resident of Canada or Mexico for some

part of the calendar year in which the

tax year began, and

- The taxpayer

provided over half of that person's

total support for the calendar year.

Medical expenses of any person who is

a dependent may be included, even if

an exemption for him or her cannot be

claimed on the return.

Medical Expenses Under A

Multiple Support Agreement - Under

the provisions of a multiple support agreement,

only the one who is considered to have

provided more than half of a person's

support under such an agreement can deduct

medical expenses paid, but the medical

directly paid by that individual. Any

medical expenses paid by others who joined

in the agreement cannot be included as

medical expenses by anyone.

|

|

|

|

Support

Claimed Under a Multiple Support Agreement

A multiple support agreement is used when

two or more people provide more than half

of a person's support, but no one alone

provides more than half. Whoever is considered

to have provided more than half of a person's

support under such an agreement can deduct

medical expenses paid.

Any medical expenses paid by others who

joined in the agreement cannot be included

as medical expenses by anyone.

|

|

|

|

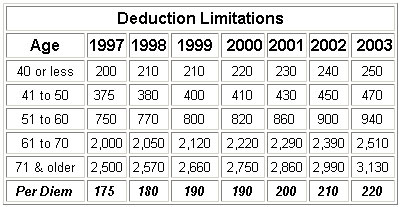

Long-Term

Care

Amounts paid for long-term care services

and certain premiums paid on long-term

care insurance are deductible as medical

expenses on Schedule A. Costs of care

provided by a relative who is not a licensed

professional or by a related corporation

or partnership don't qualify. The maximum

amount of long-term care premiums treated

as medical depends on the insured's age

and is inflation-indexed annually. The

following are the deductible amounts for

the past few years. If the taxpayer paid

long-term care premiums and qualifies

for a medical deduction on Schedule A

of their tax return and did not include

them in their medical deduction, the return

can be amended to include the deduction.

Please call this office to see if the

deduction will make a difference and to

have us prepare the amended returns.

Employees generally won't

be taxed on the value of coverage under

employer-provided long-term care plans.

However, the exclusion doesn't apply if

coverage is provided through a cafeteria

plan. In addition, long-term care services

can't be reimbursed tax-free under a flexible

spending account.

The "Long-term contract" is an

insurance contract that provides only

coverage of long-term care and meets certain

other requirements. Some long-term care

riders to life insurance will also qualify.

Benefits under a long-term care policy

after '96 (other than dividends or premium

refunds) are generally tax-free. For per-diem

contracts that pay a flat-rate benefit

without regard to actual long-term care

expenses incurred, the exclusion is limited

to $175 a day, indexed for medical cost

inflation (amount was $210 in 2002) except

when long-term care costs incurred are

more than the flat rate and are not otherwise

compensated by some other means.

A contract isn't treated as a qualified

long-term care contract unless the determination

of being chronically ill takes into account

at least five activities of daily living-eating,

toileting, transferring, bathing, dressing

and continence.

"Long-term care services" include

necessary diagnostic, preventive, therapeutic,

curing, treating, mitigating, and rehabilitative

services, maintenance or personal care

services prescribed by a licensed practitioner

for the chronically ill.

A "Chronically ill person" is one

who has been certified by a licensed healthcare

practitioner within the previous 12 months

as: (1) unable to perform at least two

activities of daily living (eating, toileting,

transferring, bathing, dressing, continence)

without substantial assistance for a period

of 90 days due to loss of functional capacity,

(2) having a similar level of disability

as determined in regulations, or (3) requiring

substantial supervision to protect from

threats to health and safety due to severe

cognitive impairment. The requirement

that a qualified long-term care insurance

contract must base its determination of

whether an individual is chronically ill

by taking into account five activities

of daily living applies only to (1) above

(being unable to perform at least two

activities of daily living).

|

|

|

|

Care

for the Elderly

When the elderly reach the point that

they can no longer care for themselves,

there are generally two courses of action

available to the caregiver; (1) Provide

for in-home care, or (2) place the individual

in a care facility. Each has its own distinct

tax ramifications:

|

|

In-home Care - If the elderly

person has the option to remain

in their home and provide in-home

care, that care is deductible as

a medical deduction, provided the

expenses are directly related to

the individual's medical care. If

the individual or individuals providing

that care also provide household

services, the cost must be allocated

between deductible medical expenses

and nondeductible personal expenses.

The individual or individuals providing

the care need not be a nurse, granted

they are providing services normally

administered by a nurse.

In-home care is also subject to

the rules for household employees

that require the employer (the elderly

individual) to withhold FICA and

Medicare taxes and issue a W-2 at

the end of the year. There are generally

state filing requirements as well,

so please call this office for assistance

in setting a household payroll.

|

|

|

Care Facility - If the option

is to place the elderly individual

in a care facility such as a convalescent

hospital, nursing home or a home

for the elderly, then the cost of

that care is deductible, provided

the primary reason for being there

is to receive medical care. If medical

care is the primary reason, then

the deduction will include the cost

of meals and lodging and no adjustment

is needed.

|

|

|

|

|

Medicaid

And Eldercare

Generally, after an individual has used

up all of their resources, Medicaid will

step in to provide the ongoing care of

the individual. Medicaid is usually a

combined Federal and state program that

pays for health and long-term care for

eligible low-income citizens and legal

residents of the United States.

It is not practical to explain all of

the various states programs. However,

since they are generally combined Federal

and state programs, there are similarities

among the various programs. This article

provides a brief overview of one state's

program. A Directory

of State sites allows you to review

the rules for any particular state.

California's version of Medicaid is referred

to as Medi-cal and the following is an

overview of the program's qualifications:

QUALIFYING FOR NURSING

HOME STAY - In order for Medi-Cal

to pay for a nursing home stay, the patient:

- Must be

admitted on a doctor's order,

- The stay

must be medically necessary, and

- With incomes

from any source are allowed to keep

only $35 per month for personal needs.

Patients with no income receive an SSI

grant of $40 per month for their Personal

Needs Allowance (PNA).

|

|

Patients who own their own home

- Medi-Cal recipients in nursing

homes who own their own homes (which

may be multiple dwelling units)

remain eligible for Medi-Cal as

long as:

- They

intend to return home; or

- The

residence is used by a spouse

and/or dependent relatives; or

- The

residence is used by a sibling

or adult child who lived there

at least one year before the owner

entered the nursing home; or

- They

make a good faith effort to sell

the home. Persons not capable

of making a good faith effort

to sell (for instance, those who

need conservatorships) remain

eligible for Medi-Cal. In that

case, bona fide steps have to

be taken so that someone else

can sell the home.

|

|

|

Married Couples - Couples

do not have to spend all their resources

in order for one spouse to be eligible

for Medi-Cal coverage in a nursing

facility. The person going into

the nursing facility can transfer

his or her interest in the home

to the spouse remaining at home

without affecting Medi-Cal eligibility.

A couple also may divide its non-exempt

property, so that the spouse at

home may keep up to $1,976 a month

of the couple's income and up to

$79,020 of the other assets for

his/her needs. The spouse at home

may also keep any independent income.

A couple may divide their property

however they wish. In determining

eligibility under the spousal impoverishment

provisions, Medi-Cal counts the

property held in the name of either

or both spouses. As soon as the

countable non-exempt property is

below $81,020 ($79,020 + $2,000

which can be retained by the institutionalized

spouse), the county can establish

initial eligibility. The couple

then has at least 90 days to transfer

everything but $2,000 into the name

of the non-institutionalized spouse.

The non-institutionalized spouse

may retain all of the income that

he or she receives in his or her

own name. Consult legal services

or a private attorney familiar with

Medi-Cal law if either you or your

spouse may need nursing facility

care.

|

FINANCING NURSING HOME CARE -

Generally, a nursing facility's administration

will help determine if the patient is

eligible for Medi-Cal to pay the costs

of the nursing home. If not, they can

explain under what conditions the patient

may become eligible in the future. The

law requires that nursing home residents

receive identical treatment regarding

transfer, discharge, and provision of

services regardless of the source of payment.

A Medi-Cal resident can stay in any bed

in a nursing facility.

Spousal Impoverishment Provision

- Couples looking at nursing home placement

for a spouse need to be aware of the special

laws enacted that allow the spouse remaining

at home to keep a certain amount of income

and resources when the other spouse enters

a nursing home. This is intended to prevent

impoverishment of the spouse at home.

|

|

Community spouse's monthly maintenance

needs allowance: The spouse

at home may keep all of the couple's

income up to $2,019 per month (this

is the base 1998 amount which is

adjusted annually for inflation).

This is called the community spouse's

"monthly maintenance needs allowance".

Note: This amount is adjusted annually

by a cost of living increase. The

spouse at home may obtain additional

income or resources through a "fair

hearing", or by court order.

If the spouse at home receives income

above the limit in his/her name

only, he/she can keep it all (this

is called the "name on the instrument

rule"); however, he/she will

not be allowed to keep any of the

nursing facility spouse's income.

Income received by the nursing facility

spouse will go to his/her share

of cost. The spouse in the nursing

home is allowed to keep $35 monthly

for personal needs ("personal needs

allowance").

|

|

|

Resources: The spouse at

home can keep up to $80,760 (this

is the base 1998 amount which is

adjusted annually for inflation)

in resources, and the institutionalized

spouse may keep up to $2,000. (Different

laws apply to spouses who entered

a nursing facility before September

30, 1989. If this is the case, the

individual should contact a lawyer/advocate

knowledgeable about this area of

the law.) Both separate property

(i.e., from a previous marriage

or inheritance) and community property

that is not exempt are combined

and counted at the time of application

for Medi-Cal. Once the resource

limit has been reached, all ownership

interest should be transferred to

the spouse at home. The institutionalized

spouse's $2,000 resource limit should

be kept separately and accounted

for separately.

|

TRANSFER OF ASSETS - Institutionalized

Medi-Cal recipients or applicants who

transfer non-exempt assets for less than

fair market value during a 36-month "look

back" period may be subject to a period

of ineligibility. The length of the ineligibility

period depends on the value of the transferred

asset or resource and date of transfer

period. The period of ineligibility begins

on the date the transfer was made. The

36-month "look back" period begins when

an institutionalized person applies for

Medi-Cal or when a Medi-Cal recipient

is admitted to a nursing facility. A 60-month

"look back" period for assets from certain

trusts is also required. Federal law amended

trust regulations makes it more difficult

to set up a Medicaid qualifying trust

for eligibility and estate claims purposes.

For a trust already established, it is

recommended that an attorney review it.

|

| |

| |

| |

|

|

|

|

|